L’essor des cryptomonnaies a suscité un débat intense sur leur potentiel à favoriser l’inclusion financière mondiale. Avec l’émergence de ces monnaies numériques, de nombreuses personnes espèrent que les populations non bancarisées pourront accéder plus facilement aux services financiers de base, réduisant ainsi l’écart économique mondial. Cependant, de nombreux défis subsistent, remettant en question l’efficacité réelle des cryptomonnaies dans ce domaine.

Challenges of cryptocurrencies for financial inclusion

Volatility and Trust Issues

The inherent volatility of cryptocurrencies poses a major challenge. With prices that can fluctuate widely within a short period, potential users may find it difficult to trust them as a stable means of value exchange. This unpredictability can deter individuals who are already cautious about entering the financial mainstream.

Technological Barriers

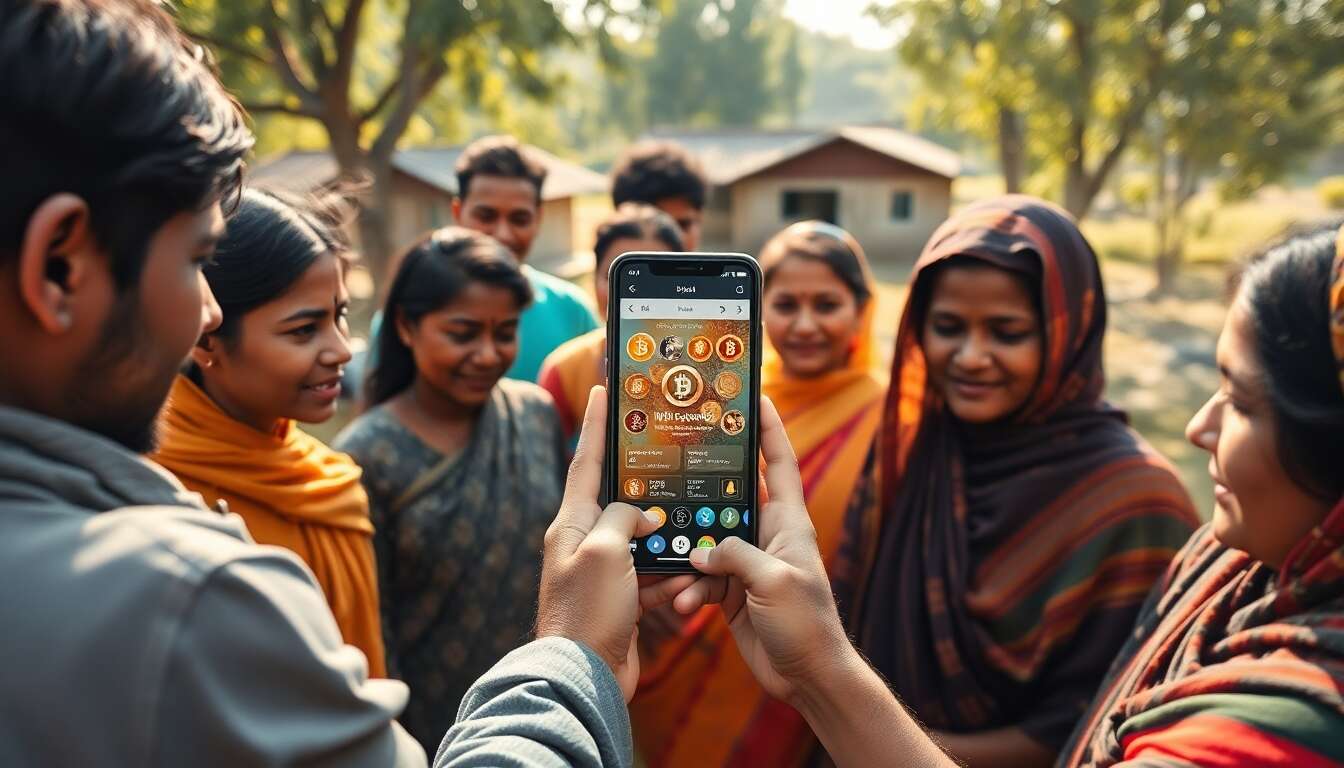

Access to the necessary technology remains a barrier. While cryptocurrencies promise accessibility, they still require internet access and a certain level of digital literacy. Many in developing regions lack either or both, limiting the extent to which cryptocurrencies can currently serve as a universal solution.

Security Concerns

The security of cryptocurrency transactions is another point of contention. The risk of hacks and scams can undermine confidence, especially among those who are not tech-savvy. Ensuring robust security measures is crucial to protect users and their assets.

Despite these challenges, the potential role of cryptocurrencies in enhancing financial inclusion remains a compelling topic for further exploration.

Potential of cryptocurrencies in developing countries

Financial Independence

In many developing countries, cryptocurrencies offer a path to financial independence. By bypassing traditional banking systems, individuals can engage in economic activities without the barriers posed by limited banking infrastructure.

Remittances

Cryptocurrencies can revolutionize remittances, often a lifeline for families in developing nations. With lower fees and faster transaction times, they provide a more efficient alternative to traditional money transfer services.

- Lower transaction costs

- Faster transfer times

- Increased accessibility

The ability to send and receive money more easily can significantly enhance the financial stability of communities dependent on remittances.

As we delve into the regulatory aspects, it is important to consider how these developments can be safeguarded.

Regulatory challenges and cryptocurrency transaction security

Regulatory Frameworks

The absence of a unified regulatory framework across countries presents a challenge. Different approaches to regulation can create inconsistencies and uncertainties for users and investors. A balanced framework is essential to protect consumers while fostering innovation.

Security Measures

Ensuring transaction security is paramount. Implementing advanced security protocols and educating users about safe practices can mitigate risks and build trust in cryptocurrency systems.

| Challenge | Impact |

|---|---|

| Regulatory inconsistency | Market uncertainty |

| Lack of security measures | Increased risk of fraud |

Understanding these regulatory and security challenges is critical as we examine the broader economic implications of cryptocurrencies.

Global economic impact of cryptocurrencies

Market Disruption

Cryptocurrencies have the potential to disrupt traditional financial markets by offering alternatives to conventional banking and investment systems. This disruption can lead to increased competition and innovation in the financial sector.

Economic Growth

By enabling new forms of economic activity and investment, cryptocurrencies can contribute to economic growth. They offer opportunities for startups and tech companies to develop new products and services, fostering a more dynamic economic environment.

The interplay between cryptocurrencies and economic growth sets the stage for discussing their environmental implications.

Cryptocurrencies and energy transition

Environmental Concerns

One of the major criticisms of cryptocurrencies, particularly Bitcoin, is their environmental impact. The energy-intensive nature of mining operations has raised concerns about their sustainability and contribution to climate change.

Innovative Solutions

In response, there is a growing push towards more energy-efficient consensus mechanisms, such as proof-of-stake, which require significantly less energy than traditional mining processes.

- Transition to renewable energy sources

- Development of energy-efficient technologies

- Increased awareness of environmental impact

As cryptocurrencies evolve, their ability to integrate sustainable practices will play a crucial role in their future development.

Future perspectives of cryptocurrencies in financial inclusion

Technological Advancements

Advancements in blockchain technology promise to enhance the functionality and accessibility of cryptocurrencies, making them more viable for financial inclusion on a global scale.

Broader Adoption

As awareness and understanding of cryptocurrencies grow, their adoption is likely to increase. This broader adoption could lead to more inclusive financial systems that cater to previously underserved populations.

Overall, while challenges remain, the potential of cryptocurrencies to transform financial inclusion is significant. By addressing these obstacles, the financial landscape can become more equitable and accessible to all.